The Department For

Transport claims that the new Uninsured Drivers Agreement 2015 complies fully

with European law.

In an interview with the insurance journal, Post, published as

an online article on 14 July under the heading

MIB and DfT dispute allegations of uninsured drivers' agreement

'shambles' an unnamed DfT official responded to my letter of complaint (

see earlier post), as follows:

'The government believes the new agreement with the [MIB] on uninsured

drivers is fully compliant with EU law. We are currently considering our

response to Mr Bevan's letter and will respond in due course'

In the same Post article, MIB spokesperson, Mr Ryman-Tubb, is

reported as asserting that the agreement was considered ‘very carefully’ by the MIB, the DfT and legal teams. He went as far as to declare that the agreement would not be amended.

With all due respect, evidently not ‘carefully’ enough!

A bodged job

The Uninsured Drivers Agreement 2015 does in fact contain

many breaches of European law that that disadvantage, and in certain instances

dis-entitle completely, accident victims’ legal entitlement to compensatory

redress. I will be providing detailed

training on this shortly but the following three illustrations should suffice

for present purposes:

·

In clause

6, in what appears to be a provision primarily intended to deflect

liability for credit hire claims where the victims are already covered against

the risk of non recovery the MIB is entitled to deduct any other sums received or

receivable in compensation. The express

exclusion of refundable advances by employers and payments received from the

Criminal Injuries Compensation Authority, and the detailed provisions that

penalise a victim for not utilising their own insurance indicates, as under the

current clause 17, that the MIB can deduct any accident insurance payments that

victim’s of insured drivers would be entitled to receive in addition to their

compensation, under our normal common law rules. This is also a blatantly unlawful and is

contrary to public policy as it discourages people from taking prudent steps to

provide for exigencies.

·

In clause

7 anyone who knew the driver might be uninsured is unable to claim any

property damage loss. This exclusion is

not permitted by the European directives on motor insurance. It is also unjust as it denies compensation

to a near neighbour of an uninsured driver whose parked car is damaged in a housing estate where it is common

knowledge that the defendant is uninsured or the owner of a car parked in a bowls club who is a mere acquaintance of the defendant but who overheard a

conversation to the effect that defendant’s insurance had lapsed. In both cases

the claimants are not at fault nor personally associated with the uninsured

driving other than as a victim.

·

The clause

9 exclusion of liability if the uninsured driver’s use is connected with an

act of terrorism is another flagrant breach, as it is clearly not permitted under

European law. It also inconsistent to pay

out on a claim by a hapless victim of a hit and run accident caused by the

get-away driver of a bank heist but not where the same unfortunate individual

happens to be hit by a fleeing animal liberationist or anti-abortionist

fanatic.

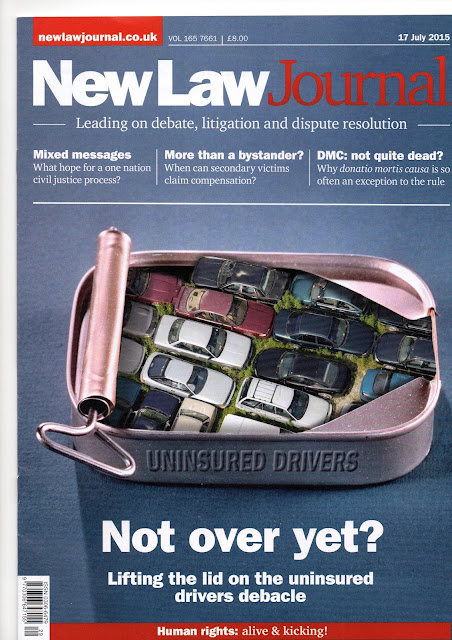

This is by no means an exhaustive list. This is why I have described the Uninsured

Drivers Agreement 2015 as a bodged job.

An empty consultation

The DfT signed off the Uninsured Drivers Agreement on 3 July. It then presented this to the world as a

fait accompli in its email dated 6 July,

announcing its coming into force in less than a month. This came as quite a surprise to many of us

who participated the DfT’s February 2013 consultation on

Review of the uninsured and untraced drivers' agreements, in which

it put forward is proposals, which to all intents and purposes, is

substantially what we see in the new scheme.

I was not alone in criticising the proposals as being flawed, too limited in scope and in places even suggesting unlawful provisions, nor in calling

for both of the MIB schemes to be cured of the numerous defects that breached the

minimum standard of compensatory protection required under European law.

The DfT’s consultation process closed in April 2013. Then after some delay, the minister announced

that he would provide a full response but delayed to the Autumn of 2013, which I

and others naturally assumed would address our concerns. Then we heard nothing more, for nearly two

years! Then, finally, instead of

responding in full to the consultations, the DfT simply went ahead and announced the new agreement in the terms originally proposed. This surely makes a mockery of

the consultation process.